The aspiration for any founder should not be income but equity. It’s a subtle change of thinking but it will lead you in a much better direction. A lot of people start a business but very few actually get to sell it. It’s an alarming trend that needs deeper thinking and a better strategy, especially if you’re looking to create business value.

83% of Australian businesses have no exit plan – they are failing to even attempt to document one.

The majority of these owners are no more than 5 to 10 years out from wanting to sell or pass their business on to someone else.

Time is ticking down – but the urgency to do anything meaningful is still not present.

Did you know that 70-80% of businesses fail to sell their business on the first attempt?

And for those businesses who are fortunate enough to get their business across the finish line there is often a high degree of regret after the sale has gone through with both the price and terms of the deal they received. Seller’s remorse is a real thing.

Whilst the focus on price and deal terms are important – most owners are missing out on a few important steps before they get to the negotiation table.

Because you actually won’t get the price and terms you want without this…

Transferable market value.

So when people try to sell their business it’s no surprise that what often follows is a letdown.

Expectations are out of alignment.

And while sellers continue to point their frustration at the market for not seeing the value they do, they’ve neglected one important fact.

The business has been designed the wrong way – from the very start.

The business is highly likely to be centered around the founder and the income it provides to them. Rather than a business built around operating teams, margin growth, cash flow generation and growth potential.

And that’s not to say your business isn’t profitable.

However, the areas of concern for buyers haven’t been considered to a level they need to be. Which ends up shaving too much off that asking price and putting terms forward that are less than agreeable.

So before you go down the very windy path that is exit planning and gearing your business for sale we’ve outlines seven stages that will help you create business value. As you progress through each of these stages, the equity value of your business will grow and therefore your exit options become more appealing.

The higher your Valuation the better the price and terms you can negotiate.

Stage one: Design value

Most valuation experts will tell you that identifying value is always the first step and should never be skipped. But to me, this comes later.

We first have to design a valuable business. One that has its own set of expertise, capital and systems to grow and operate independent of its owners.

If you can design your business in a certain way – you can reverse engineer a better outcome – beginning with the end in mind.

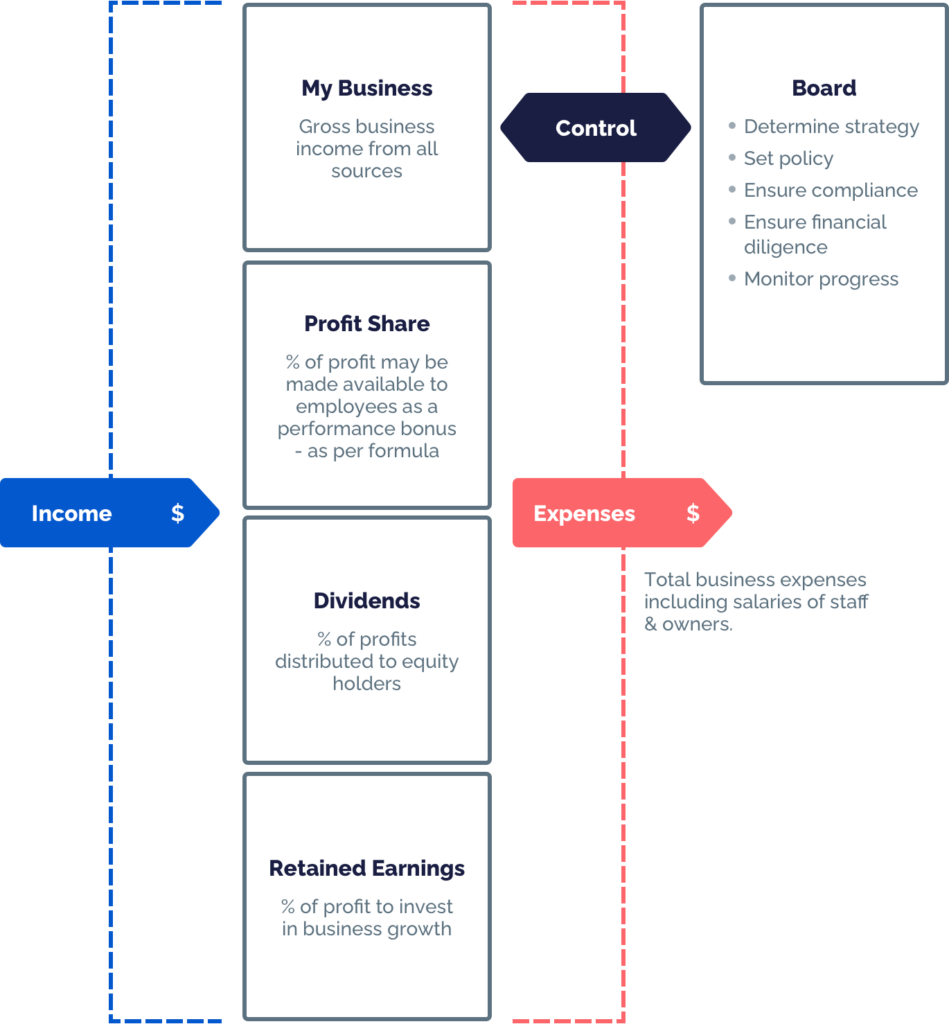

First, you must understand your business has three parts:

- Income

- Equity

- Control

Using the model below, equity holders are paid market rates for the functional roles they perform and are willing to reinvest their capital into growing and improving the asset value over time.

If you can design your business in a way that creates business value from the start – rather than attempting to manufacture value at later stages of your growth cycle – the approach taken by 70-80% – you’re going to increase your chances of success.

The good news is that it’s never too late to try to create it.

Stage two: Create business value

To grow equity value it needs to be created in the first place.

Using a Valuation Growth Framework helps create a vision of what equity value the business owner wants to achieve.

Using a Valuation framework – you can look at your business through a much clearer lens than reviewing a set of financials. You can clearly see how a business creates equity value as it grows.

This replaces the need to reengineer your financial numbers a certain way to make the business appear more profitable than it really is. If the levers aren’t there, it doesn’t matter what is done with the P&L.

The other advantage of using a Valuation framework is that you can:

- Identify the true vision you have for your business.

- Create alignment between your co-founders

- Identify the specific projects to drive up the equity of the business

Increasing profit is not the only way to create business value. It’s a big part of it but it’s not the whole picture.

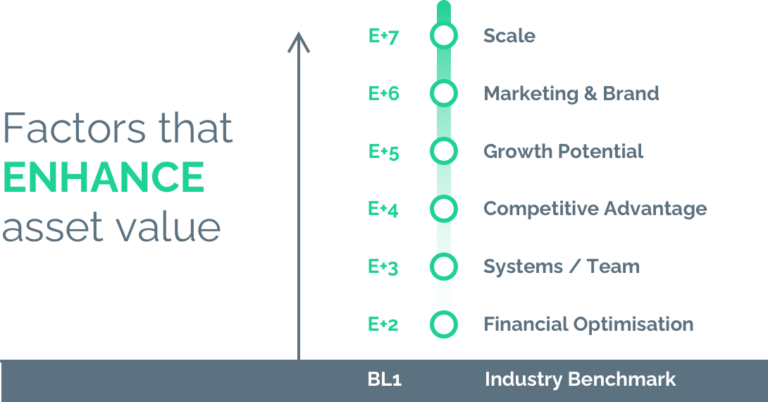

You need to also consider the other side of the Enterprise Value formula in the factors than drive up the business multiple.

Going deep into a business multiple allows you to benchmark your business against others and work through the specific projects and initiatives that will push the business above those industry benchmarks. This will build up momentum inside of your business that will be hard to stop as you start to move ahead of competitors.

This will force a shift in your approach to building both scale and equity value. And balance growth, operations, functions, efficiency and risks.

All of which contribute to the equity value of a business. Not just profit.

Learning about the importance of valuation and business multiples – has a very nice side effect. The revenue and profits of the business grow more sustainably and your cash flow increases.

This allows you to invest more into growth and point the business in the direction you want it to go…

Then you can go to the next step…

Stage three: Identify value

Now it’s time to see whether you’re actually on the right track to create business value.

It’s time to unpack the numbers and complete a business valuation.

This should be done every year…whether you think so or not…because how do you know whether you are on track?

Sometimes we need to hit pause…and a Valuation is essentially that.

A way to clearly see if you’ve done a great job or more work is needed before you try to sell…

A Valuation will give you a gauge to benchmark your business against others and set a new baseline for everything you do from this point on.

The importance of this step cannot be overstated:To

- 80-90% of your total net worth is likely to be locked up inside your business

- You need a method and a system to focus you and your team on something that matters: maximising equity value

- The ability to unlock that value at some point in the future is going to make a significant impact on your life.

- Knowing the valuation of your business helps you plan and gives you something to aim for.

And once you’ve reached this point on the journey it’s time to…

Stage four: Protect value

Knowing the value of your business is simply a starting point. You need to take this knowledge to a new level and implement smarter ways to protect it.

Because understanding both financial implications and business risks will secure the future.

Most advisers are risk-averse. And most of them are not entrepreneurial at all – like you are…

Their advice will always lean on the conservative side and shy away from making big financial bets.

This goes against the grain of exponential value creation and building companies that scale.

But when the business has reached a certain size and level of profitability – no one wants to be responsible for advising you to go in the wrong direction.

To get through this step you actually have to take some action. Because even if you did nothing else, but simply mitigate your risks – it will have a positive impact on value.

The reason is Valuations are largely based on both real and perceived risks from a buyer’s point of view.

The trick here is not to put up walls and try and insulate yourself. That’s just not realistic. It’s about understanding both your risk tolerance and willingness to complete the actions necessary to protect the equity value you’ve created.

Let’s also consider the five D’s:

Death, Disability, Divorce, Distress and Disagreement.

Most of us don’t think these things will ever happen to us. But the statistics tell us the opposite.

In reality, there is more than a 50% chance that your business will be impacted by at least one of the 5 D’s at some point: so it’s important you have a plan.

Unmanaged risk is the biggest killer of value so if you haven’t documented a plan around protecting the value of the business – it might leave an indelible mark on your future net worth.

And you don’t want to miss out on the next step…

Stage five: Grow value

Once you’ve put a plan together to protect the equity value of the business – you can now focus on growth.

In this stage, you will want to take a longer-term view than you had before. Prioritizing strategic actions over being dis-organised or reactive.

Growing value happens from increases in revenue, cash flow and improving your business multiple.

You need to factor in your tangible and intangible assets and the risks associated with operating the business.

Intangible assets are things you create but can’t see.

Tangible assets are things you can see but didn’t create.

Which do you think is going to influence your business Valuation more?

Intangible assets are ‘knowledge capital’.

Yes, you have this knowledge in your business right now…but it’s probably not well documented…

Creating business value can be divided into 4 key areas:

- Team Capability - the value of your talent

- Structural - the value of your systems and intellectual property

- Customer - the value of your customer relationships and the untapped growth potential

- Social - the value of your brand and culture of the organization

How well you manage all these areas is what actually creates the sales and profits we all seek.

Manage them well and you’ll have more growth and profits…

Mismanage them and you won’t.

Now for the best part…

Stage six: Harvest value

At some point your business will have to come to an end.

We constantly hear – I’m not looking to sell my business.

This statement is only true at a certain point in time.

The reality is once you grow to a certain stage and size – you should always be looking to sell your business.

Because if you look to do it this way – you will make the right choices…

Because cashing in your chips and harvesting the value from your business is not easy…but it is straightforward once you’ve optimised the equity value of your business…

Whilst this decision may be far off in your future – time moves quickly.

Just look back on the last 10 years…it’s flown by…

The next 10 are just around the corner. It’s amazing to think what you can achieve in that time.

Harvesting represents moving through a growing season – where harvesting marks the end of a growth cycle for your business.

This is the best time to sell your business.

Trying to sell your business when you’ve had enough or not keeping up with changes in the industry could prove to be a sub-optimal experience. Selling with this mindset is going to be a huge financial mistake.

There are many ways to transition and harvest the equity value of your business – from internal / intergenerational buyouts to external transitions where you sell to someone else.

What’s important here is to do your numbers and explore your options.

Because possibilities are everywhere.

You just need to know where to look so you can get to the fun part…

Stage seven: Manage value

This may seem obvious but it’s something we see most sellers get wrong.

The value the business creates ends up getting eroded away as a result of lack of planning here.

Once you create business value, it should be yours to enjoy.

To effectively achieve anything with your finances you need to manage your own affairs like a pro.

Managing your finances and structuring your personal affairs often comes a very distant second for most business owners.

They are constantly distracted by the business instead of keeping their wealth front and centre.

You need a good personal financial plan to sit alongside your business.

That way in the end the value you get from the business sets you up for a better life.

This then leads us to the final important question…and here now comes the accountant in me…

What tax will you pay when you eventually sell your business?

When it comes time to sell you want to make sure you take out every dollar you can. After all, you’ve built this asset so why would you want to give a big chunk of it away to the tax man.

Yet this is what most business owners do everyday because they didn’t structure themselves to enable them to bank most of the return.

Selling your business comes with a cost. That is the tax you will pay on the net proceeds…after factoring in what it cost to create the asset and sell it.

For tax purposes selling your business is considered part of your business income so it’s taxed under the tax rate you used for your business structure.

And regardless of your structure, selling your business is considered selling an asset. Like a property. This means if you make a profit on the sale – it triggers capital gains tax.

But when done correctly, there are a wide number of CGT tax concessions on offer – that you must explore with your accountant at least 12-18 months before you sell.

You simply need to know which ones you qualify for and which you don’t.

Closing thoughts…

Ideally, you want to be in a place where you know your Valuation and what offers you’ll likely accept…work out the cost including the taxes involved to determine whether the decision to sell actually makes financial sense.

It’s the quantification of the real financial end point…and what ultimately ends up in your pocket.

We’ve just described the ideal process and journey to create business value ..but guess what…

You and I both know it rarely works out how we want.

But that’s beside the point…even if you simply act on one of these steps the outcome could be vastly different than if you ignored every singe one of them.

It’s good to seek out information about these sorts of things – but in my experience, it’s far better to have someone in your corner that gets it more than you do.

Someone who has sat in and beside real businesses that have been built and sold.

I wish you the best of luck as you embark on the journey to create business value.

If you’d like a head start on all this we have a free Business Valuation Calculator that you can use. Or, book in a discovery call with us today to start creating business value.